Medium-term business plan

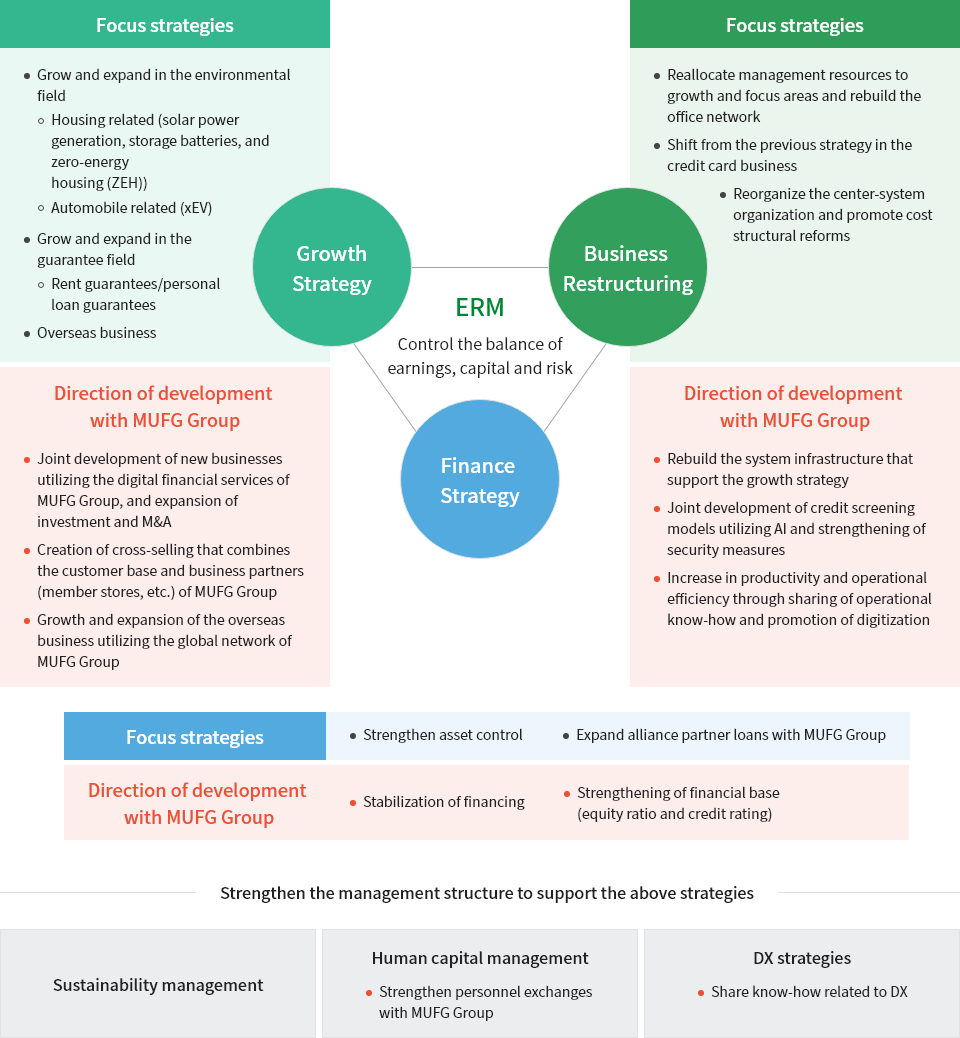

JACCS has formulated a medium-term management plan targeting the three years from FY2025 to FY2027, which is oriented toward rebuilding the management structure and returning the JACCS Group to growth. The JACCS Group will engage all employees in initiatives with the aligned purpose to become a strong corporate group that is trusted and relied upon by all its stakeholders and realize sustained growth.

Quantitative Targets

| Consolidated(100 millions of Yen) | FY03/26 | FY03/27 | FY03/28 |

|---|---|---|---|

| Revenues | 1,915 | 1,990 | 2,045 |

| Ordinary Income | 200 | 250 | 310 |

| Net Income Attributable to Owners of the Parent | 155 | 180 | 230 |

Dividend policy

The basic dividend policy of JACCS is to make it a management priority to provide stable and continuous dividends to the shareholders and to strengthen the Company’s competitiveness and enhance shareholder value through expanding internal reserves and ensuring the effective utilization of capital. Under this basic policy, the dividend policy for this medium-term business plan is to aim for a dividend on equity ratio (DOE) of 3.0% or a dividend payout ratio of 40%, whichever is higher.